See How to Stop Payment & Cancel Checks for more information.Īccess information and resources for the following AP-owned tax forms: Form 1099-MISC, Form 1099-NEC, Form 592-B, Form CA 590, Form CA 587, and Form W-9. The process takes three to five business days. This address can be the same as the company address or can be different depending on the processes of the company. In this customizing activity you define the address that will be used by customers or vendors for reply. Request For Stop Payment / Cancellation of Vendor Check (PDF)Īllows non-received, expired and lost checks to be cancelled and potentially reissued. The department faxes the completed form to AP. To configure SAP balance confirmation printing, you only need to define the reply addresses that will be printed on the output. Establishments and closures should be directed to General Accounting. Used to correct (adjust) the amount of an invoice. The department submits a copy of this form and the original invoice to AP in lieu of a corrected invoice from the vendor.Ĭomplete and submit the form to AP for replenishment of petty cash funds (PCF). The recipient's bank should receive payment within five business days. Wire transfers are processed daily by 10 a.m. International wire transfers are a payment mechanism used for certain foreign vendors. The department should complete the Foreign Wire Transfer Request Form and forward the original to AP. Note: A One-Time Payee cannot be set up for EFT payments. Vendors may sign up for EFT by completing the UCLA EFT Authorization Form. Please attach a voided check to the form, and mail it to the Accounts Payable (AP) address listed on the form. Used by departments to request payment when an actual invoice cannot be provided by a vendor.Įlectronic Funds Transfer (EFT) Authorization (PDF)Įlectronic Funds Transfer (EFT) is the automatic deposit of funds directly into a vendor's bank account.

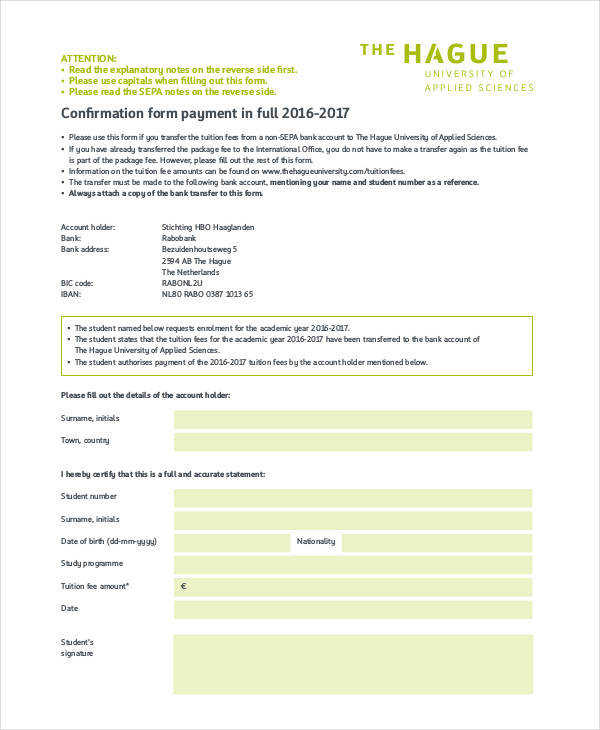

Positive ConfirmationĪ positive confirmation is a request to provide a response to the auditor, whether or not the customer agrees with the receivable information listed in the confirmation.Ī negative confirmation is a request to contact the auditor only if the customer has an issue with the accounts receivable information contained within the confirmation. There are two forms of confirmation, which are noted below. This Singapore Standard on Auditing (SSA) deals with the auditors use of external confirmation procedures to obtain audit evidence in accordance with the. The Difference Between Positive and Negative Confirmations

Since the information obtained through confirmations comes from a third party, it is considered to be of higher quality than any information that an auditor could have obtained from the client company's internal records. The auditor typically selects customers for confirmation that have large outstanding receivable balances, with secondary consideration given to overdue receivables, followed by a random selection of customers having smaller receivable balances. The letter requests that customers contact the auditors directly with the total amount of accounts receivable from the company that was on their books as of the date specified in the confirmation letter. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report. The auditor does so with an accounts receivable confirmation. ISA 505 defines external confirmation as audit evidence obtained as a direct. When an auditor is examining the accounting records of a client company, a primary technique for verifying the existence of accounts receivable is to confirm them with the company's customers. This results in excess depreciation, it is designed espically for you.

0 kommentar(er)

0 kommentar(er)